Monetary Inflation

Inflation drove the decisions of the founders and U.S. policy moments throughout history. See how that history impacts modern discourse.

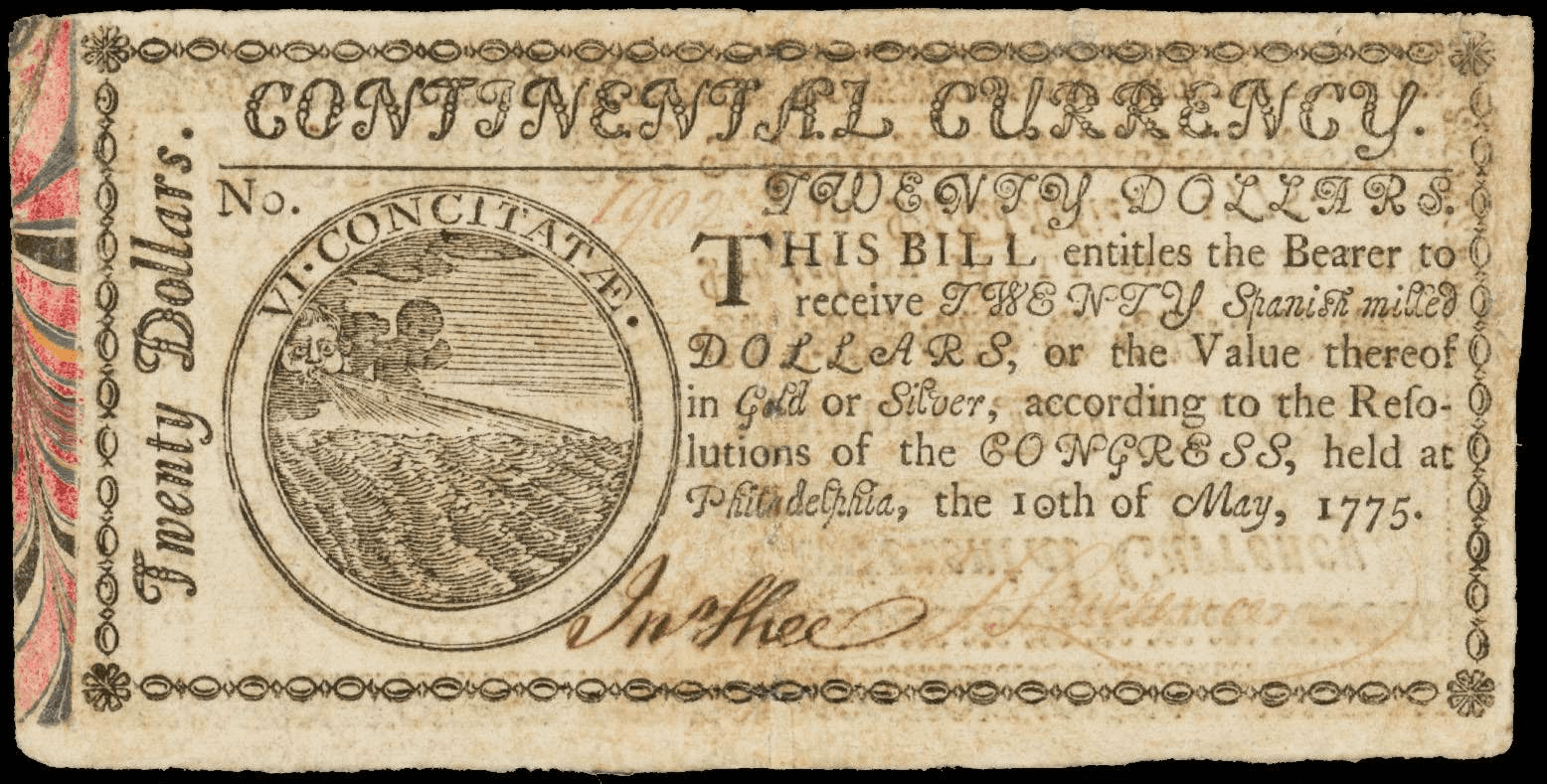

During the War for Independence, the newly formed United States needed some form of currency alternative. The Continental Congress created the “Continental” paper currency backed by “good faith and intentions.” Since it was not backed by gold or silver, merchants marked up the prices of goods purchased using Continentals. The Founder’s terrible experience using unbacked currency led to many of their future economic decisions.

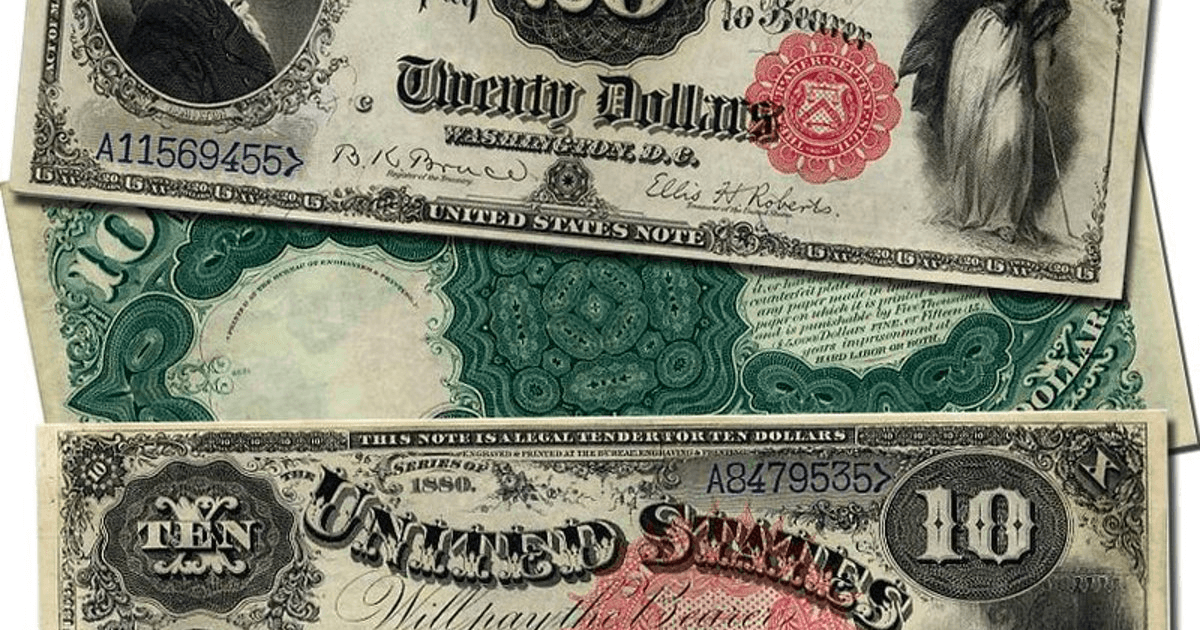

By 1788, the gold standard was adopted to back American currencies. Article I Section X of the Constitution states, “No State shall … make any Thing but gold and silver Coin a Tender in Payment of Debts…” Having experienced the inflation of the unbacked Continentals, the Founders included this line of the constitution to standardize U.S. currency and prevent hyperinflation. Later in 1792, the Coinage Act created the United States Mint in Philadelphia. The establishment of the Mint meant that the United States had formally adopted the U.S. dollar as their currency. The law created U.S. eagles, dollars, cents, and sub-denominations of each. The act also specified each coin's metallic composition and weight in copper, silver, or gold.

During the Civil war the Union and Confederacy developed opposing currencies to finance the war efforts. Characterized by their green print, "Greenbacks" was a negative term for the original dollar we see today; since the currency did not have secure financial backing authority and banks were reluctant to give customers the full value of the dollar.

With the history of unbacked, unstandardized, and fluctuating currencies, in 1913 the Federal Reserve - known as The Fed - was established to combat the Great Depression. This central bank of the United States was tasked with managing the nation's money supply and to develop rules and responsibilities for banking. The Fed - and theories of centralized banking - ultimately led to the questionably unconstitutional end of the gold standard in favor of deficit spending.

Deficit spending has become a major political divide as Republicans have called for reducing the deficit and curbing spending - citing major inflation as a chief concern. While Democrats tend to follow a different economic model looking for increases in government spending that drive opportunities in other sectors of the economy. The history of fluctuating currency in the United States is far from over!