History

- 1776-1913|

Monetary Inflation

Inflation drove the decisions of the founders and U.S. policy moments throughout history. See how that history impacts modern discourse.

- 1980-2022|

Political Impact of Inflation

Gas prices and Covid-19-based inflation have driven many political talking points. Rampant inflation in the economy has historically led to political upheaval.

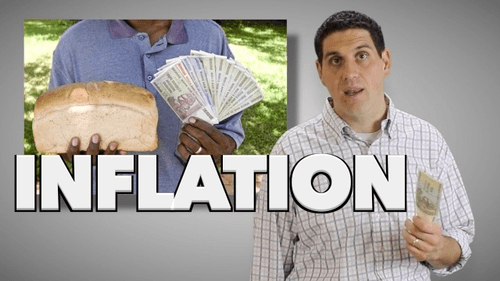

Introduction

Basics of Inflation

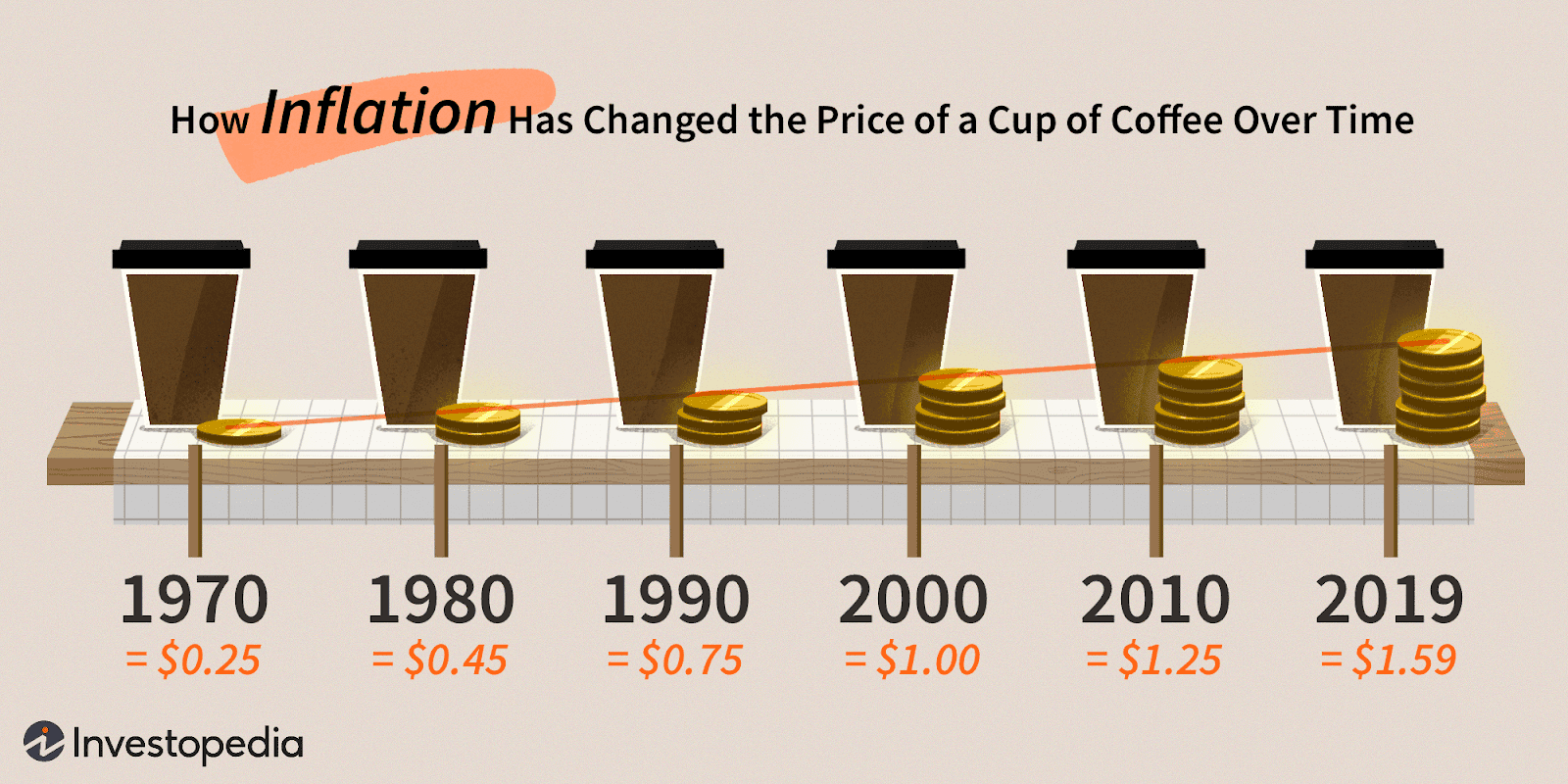

Inflation is essentially when the purchasing power of a unit of currency is reduced. In the U.S., the purchasing power of a one-dollar bill has dropped 41.6% since 2005. In other words, prices increased by about 42%! A $10,000 painting in 2005 would cost at least $14,160 today based on inflation alone. If you buried $10,000 cash in your backyard and left it alone from 2005 to 2021, that money would be worth 41.6% less than it was in 2005, even though it's still $10,000 in cash.

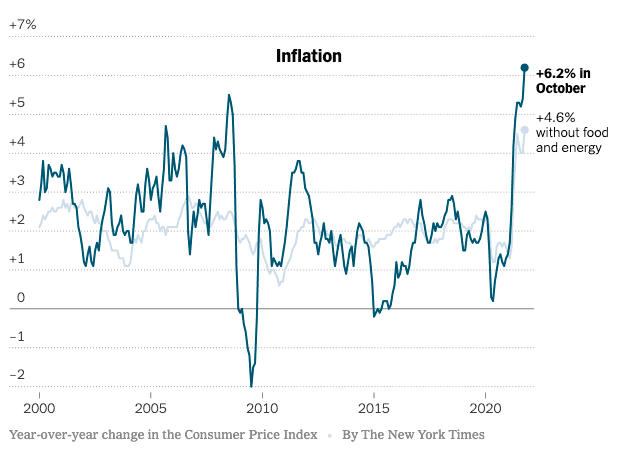

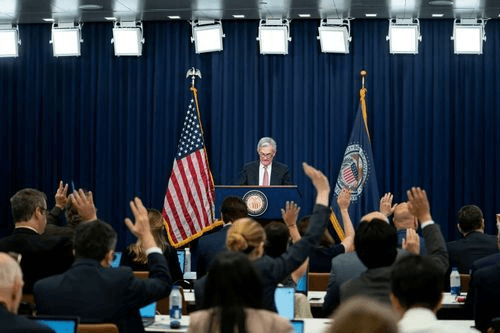

Surprisingly, inflation is not only common but considered by many to be a positive economic phenomenon. The central banking system of the United States of America, called the Federal Reserve, aims to maintain an inflation rate of 2-3% per year. In other words, prices are designed to increase over time to encourage more spending. In a graph of the US inflation rate since 2000, the inflation rate is constantly changing but consistently stays more than zero.

Types of Inflation

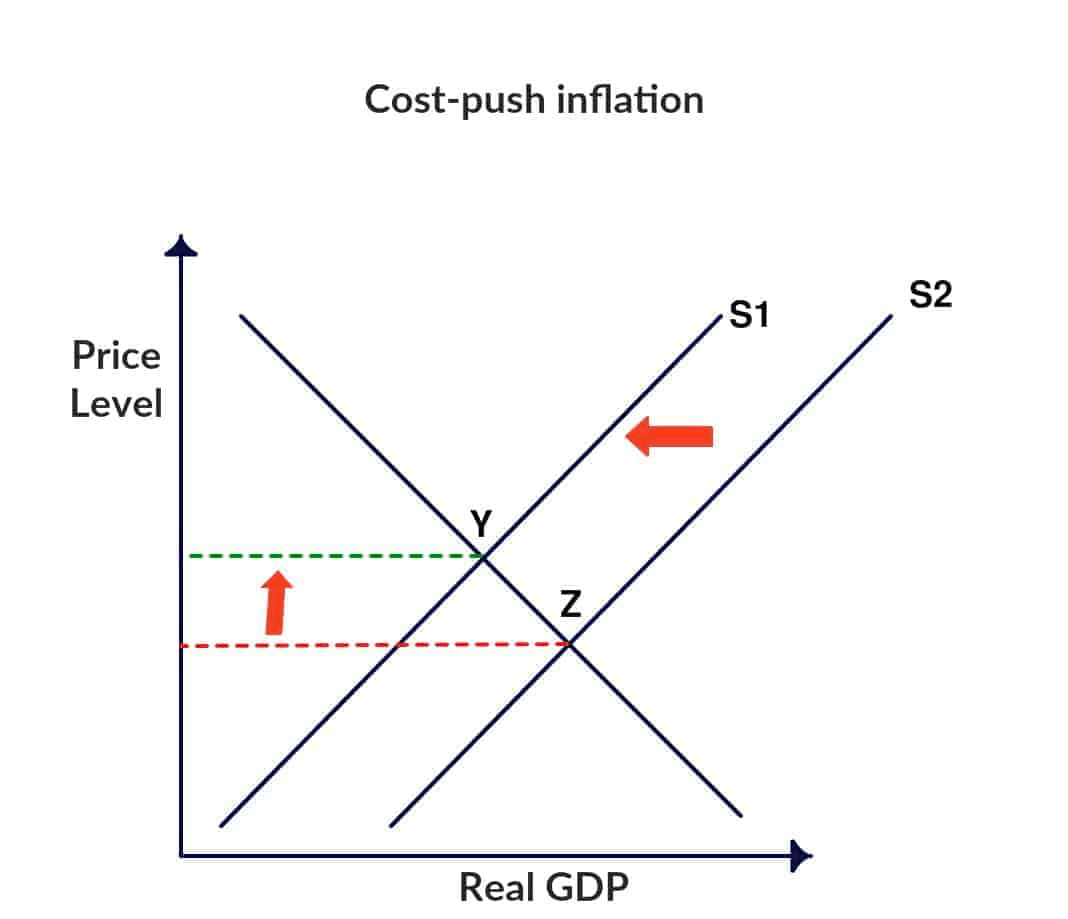

Cost-Push Inflation. Cost-Push Inflation occurs when the costs of running a business or producing a product increase. When the cost of production increases, businesses usually push the increased cost on customers by raising the price of the good or service. With many factors and steps needed to produce an important good or service, a break in the supply chain can derail the whole system. Cost-push inflation is inflation due to increased production costs (i.e. the cost of building a product), some of which include:

- Raw Material Costs

- Labor Costs

- Oil (Transportation Costs)

- Rent Prices

Demand Inflation. Demand Inflation occurs when the market demand for a good or service increases. In other words, if the number of people that want a good or service exceeds the supply available, a company can raise the price of that good or service.

Let’s say you assemble 10 ice cream sandwiches and sell them to your classmates for $3 each. At first, you’d make $30 every day. What if, as the school year goes by, more people find out how delicious your sandwiches are, and they become famous. If you can only assemble 10 sandwiches a day, it makes sense to only sell your 10 sandwiches to the ten classmates who will pay the most for them. All of a sudden your sandwiches are worth $10 each because everyone wants one!

Other types of demand inflation:

- Lowering or raising taxes impacts inflation because it changes the amount of money that an individual has. High taxes reduce an individual's net income, while low tax increases net income in the short term. Lower taxes, for example, could create higher demand for goods and services because the average person might have more money to spend, which would increase the overall demand for goods and services, allowing companies to raise prices.

- Lowering interest rates. Suppose interest rates are reduced, the “fee” for taking out a loan decreases. With lower interest rates, Loans become cheaper and more attractive, giving individuals and/or companies more money to spend. Like lowering taxes, the increase in disposable income boosts overall demand for goods and services, allowing companies to raise prices.

Government Inflation. The Federal Reserve is the only government agency with the power to “print” more money. However, the Federal Reserve rarely prints physical bills. Instead, they increase the amount of money in circulation by creating more digital money to be used for things like purchasing government securities (bonds). How do bonds work? When someone “buys” a bond, what they’re really doing is lending money to the government for a set amount of time in exchange for interest payments.

Fun fact! Paper dollars in your wallet are not the primary method of storing money; 89% of U.S. dollars are digital. Only about 11% of the total money supply is physical currency. Physical or digital, the result is the same. Printing more money increases the money supply in circulation, which dilutes (decreases) the purchasing power of each bill in circulation. In general, when the supply of something (money, oil, ice cream sandwiches, etc.), the price of that thing tends to fall.

“Normal” Inflation (2-3%). An 2-3% inflation rate per year is widely considered beneficial to economic growth. Why? Inflation incentivizes people and companies to spend or invest their money. Otherwise, their money will continue to lose value the longer it sits around.

Suppose a company stored all of its cash in a vault. They might not be very motivated to do anything with that money with no inflation.

However, with inflation, that money would be losing 2-3% of its total value every year it sat in that vault. Instead, companies might hire more workers, build more manufacturing plants, or invest that money in the stock market.

There are downsides, though. From the perspective of the average American, the most significant problem posed by an inflation rate of 2-3% per year is that wages and salaries are often not adjusted to keep up with inflation.

Hyperinflation. Hyperinflation is when the currency's value depreciates (becomes less valuable) uncontrollably. Hyperinflation can occur if the government keeps printing money but there is either a lack of economic growth or the demand for products vastly outpaces the supply. One of the most famous examples of hyperinflation happened in 1923 Germany, where money became so worthless, Germans would use it as fuel for fires to stay warm or other creative uses.

Deflation. If the price of goods and services decreases, the opposite of inflation comes into play; deflation. Experiencing deflation for an extended amount of time is considered to be negative by economists. If inflation incentivizes spending or investing money, deflation does the exact opposite. It incentivizes people or companies to hold onto cash because it will be worth more in the future. Storing money can stifle economic activity since fewer people are spending.

Sample Case → Striking Oil

***While this sample case is about oil, it represents how inflation works in general; money, goods, and services.

After years of economic troubles in her home state, Melissa decided a change of scenery was just what she needed. She bought a cabin and moved to the remote wilderness in Montana to start fresh. While digging out some ground to build a very deep well, Melissa struck oil! Ecstatic with her newfound fortune, Melissa wonders what effects her discovery will have on the economy.

If Montana had an oil reserve of 100 barrels, 1 barrel of oil would be 1% of the total reserve. Melissa found 50 barrels worth of oil on her property.

Discussion Question:

- What impact do you think Melissa’s discovery will have on the Montana oil market?

- What is Melissa's most effective strategy to make the most money?

Melissa’s discovery of 50 barrels increased Montana’s total oil supply by 50%. Now 1 barrel of oil – out of 150 barrels – is only 0.67% of the total supply. As a result, a single barrel has decreased in value. In other words, the oil supply in Montana has undergone severe inflation with the discovery of 50 barrels on Melissa’s property.

Melissa’s discovery will increase the total oil reserves available. With more oil supply, each barrel of oil will cost less to purchase. However, this is not necessarily a positive outcome for the oil market as a whole. If the oil costs less, it is also less valuable with respect to the total reserve.

Inflation Examples

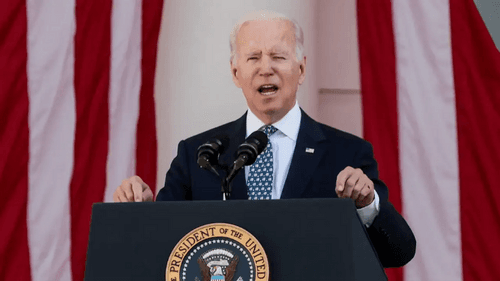

The Trump tax cuts combined with government spending added to the deficit without excess inflation; however, with the emergence of the Covid-19 pandemic, a $2 trillion stimulus combined with economic fallout drove inflation. President Biden continued to add to that inflation with the CARES Act.

In the wake of the coronavirus pandemic, the U.S. economy contracted, and unemployment rose from 4.4% in March to an astonishing 14.7% in April 2020. As a result, the government took extreme measures to avert a complete economic meltdown: lawmakers passed a series of coronavirus relief packages, allocating roughly $4.1 trillion in aid under former President Trump and $1.9 trillion under President Biden. In addition, the Federal Reserve cut its federal funds and discount rates to almost zero and purchased bonds to pump money into the economy.

While the government took these actions to protect and jumpstart the American economy, they also had some unintended consequences.

- Government Inflation. The $6 trillion in relief packages injected vast amounts of money into the economy that many Americans who lost their jobs did need. However, those same Americans found themselves with more disposable wealth (i.e., spending money), creating even more inflationary pressures.

- Demand inflation. The reopening of the economy combined with low-interest rates created high market demand, causing inflation in the short term.

- Supply problems. As producers tried to use already strained supply chains to meet that heightened demand, it has resulted in a supply shock, further increasing inflation.

The pandemic has shone light on the interconnectedness of a global supply chain, where existing economic weaknesses were amplified by increased demand, supply shocks, and an influx of government dollars. Ultimately, this has created the rampant inflation the U.S. is experiencing today.

As the 2022 midterm elections approached, inflation became a hot-button issue. In a AP-NORC polls, economic problems overtook Covid-19 concerns as one of Americans’ top issues. Amid rising inflation, perhaps one of the most notable goods to become more expensive is gasoline. High demand was met by insufficient supply, driving gas prices higher.

The Biden administration urged the Organization of the Petroleum Exporting Countries (OPEC) – the group responsible for much of the global oil supply – to increase exports in light of high prices. OPEC and its allies, however, barely adjusted their rates of production in 2022.

Terms

Purchasing Power. The number of goods or services that one unit of money can buy.

- You can purchase one (1) bag of skittles for one dollar ($1)

- Video explainer

Inflation. The decline of purchasing power of a currency over time. In other words. the decrease in the amount of goods or services that one unit of money can buy over time.

- Let’s say you could purchase one bag of skittles for $1.00 in 2020. If inflation is constant at 3% per year, that same bag of skittles would cost $1.03 in 2021.

- Video explainer

Deflation. The increase in the number of goods or services that one unit of money can buy over time.

- Let’s say you could purchase one bag of skittles for $1.00 in 2020. If deflation is constant at 3% per year, that same bag of skittles would cost $0.97 in 2021.

- Video explainer

Demand. The customers’ desire to buy goods or services at a given price.

Supply. The amount of a good or service available.

Interest Rates. A percentage of the total loan, usually calculated on an annual basis, which is owed to a lender over a predetermined period.

- Let's say you want to open a coffee shop but need $100,000, so you head over to your local bank and ask for a loan. If you meet the loan requirements, the bank will approve your loan, but they will require you to pay a fee paid each year (to make a little extra). This fee is your interest rate. In this example, you may have to pay 5% of $100,000 ($5,000) per year for 20 years. You still have to pay off the initial $100,000 – called the principal payment – but with the added expense to ensure the lender makes money, even with inflation.

- Video explainer

Full Value. Full Value is reached when the monetary value of an object matches the intrinsic value of an object. Full value is a term used to describe an asset trading at a fair price.

Narratives

Left Narrative

- Sometimes inflation is a necessary by-product of sound policy.

- Inflation is primarily influenced by the public’s economic activity, not exclusively government spending.

- Often, businesses raise their prices to widen profit margins rather than out of necessity.

Corporate Malpractice. When inflation is unnaturally high, corporate anti-consumer behavior is almost always responsible. Businesses engage in price-gouging and artificially limit supply to fatten their wallets at the expense of the American people. Republicans are more concerned with politicizing the issue of inflation than addressing its impact on consumers. They oppose every meaningful attempt to address rising prices, preferring to keep the issue for a political attack line instead of seeking to solve it.

Programs & Spending. Democrats consistently work to counter inflation’s effects while Republicans fight against them. These efforts include providing assistance to low-income Americans to cover the cost of essential goods, combating illegal business practices that drive up inflation, and funding crucial projects to ease the stress on supply chains. Democrats’ substantial investments in America sometimes cause inflationary pressures, but these effects are almost always temporary, and the benefits far outweigh them.

The Right likes to paint Democrats as the sole reason for inflation. Meanwhile, they push destabilizing economic practices that weaken the dollar’s value, such as massive tax cuts for the wealthy and unnecessary subsidies to the agriculture sector. They also gut essential programs protecting low-income Americans from rising costs.

Republicans have advocated for these fiscally irresponsible policies for decades, all while the Left has sought to prevent them. They also spent trillions of dollars under the Trump administration without any concern about how it may create more inflationary pressure. They only complain about deficit spending and inflation when Democrats are in power.

Right Narrative

- The Government should not be involved in manipulating the value of currency.

- Government policies should be mindful of their effect on the dollar before creating new dollars to foot the bill.

- Excessive and unnecessary government spending should be avoided.

- Free markets will always result in a more prosperous economy.

The Fed. Republican views on the Federal Reserve range from acceptance to audits and abolition. While some Republicans argue that the government control of monetary policy ensures a stable economy, in the wrong hands has the potential to devastate the economy. The Constitution states Congress only has the power to “coin Money, regulate the Value thereof, and of foreign Coin,” and “No state shall … coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debts….” This means that it is unconstitutional for the Federal Reserve, a creation of Congress, to issue fiat money such as the Federal Reserve Note. Moreover, the only constitutional money is gold and silver coin.

For this reason, Republicans like Rep. Thomas Massie have called to audit the Fed and restore the gold standard. Ron Paul Libertarians have called to go further and end the Fed. They believe that the government has no place in controlling monetary policy and are in favor of passing the following:

- The Federal Reserve Act of 1913 and all subsequent amendments to that act are hereby revoked.

- The gold that belongs to the United States government – which is kept on deposit with the Federal Reserve System – is transferred to the account of the United States Treasury.

The ending of the Federal Reserve would lead to free markets deciding the price of the U.S. dollar. It would prevent the government from printing fiat dollars and pushing inflation. As well, the United States dollar would be strengthened when physical metals like gold and silver back it.

Government Overreach. Government economic intervention will always have negative impacts, while free markets will be more successful and produce more economic prosperity. Countries like Venezuela nationalized industries, which meant their government-controlled oil and food production instead of private businesses. The result of this communist action was abject poverty and starvation.

Programs & Spending. One aspect of socialism is the development of government programs that trap citizens into reliance on the government. To achieve these programs, the government must spend excessive amounts of money to keep them operational. When FDR passed the New Deal, it created a work program that temporarily gave Americans jobs, but delayed the economic recovery of the Great Depression. Luckily these programs no longer exist, but Democrats still look to implement these socialist programs like housing projects and “welfare.”

President Biden attempted to pass Build Back Better in 2021, which sought to spend trillions of dollars creating new government programs. These programs would have been challenging to eliminate and required funding for every consecutive year. The initial failures of communist countries like Venezuela came from the government printing endless money to pay for government programs, thereby inflating the currency. Democrats, and in part Republicans, have overseen rampant spending in Congress in the form of omnibus spending packages. Republicans struggle to reduce spending because Democrats tie useless spending with necessary spending like military funds. Ultimately, we must end omnibus bills, debt must be reeled in, and eliminate unnecessary programs.

Bipartisan Narrative

Classroom Content

Browse videos, podcasts, news and articles from around the web about this topic. All content is tagged by bias so you can find out how people are reacting across party lines.

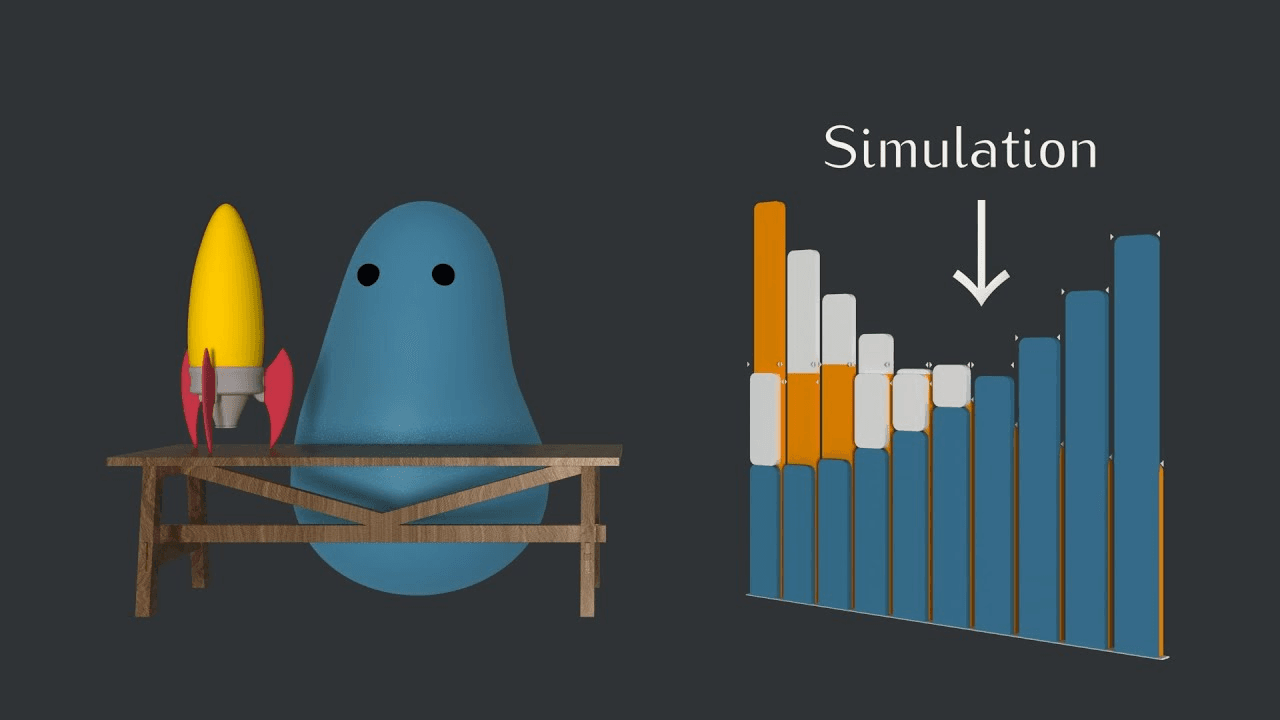

Simulating Supply and Demand

- Video •

- 3/27/2019

Cost-Push Inflation and Demand-Pull Inflation

- Video •

- 3/20/2015

Supply & Demand: An interactive explainer, from first principles

- Interactive •

- 0/1/2022

Inflation Nation

- Podcast •

- 10/15/2021

Inflation, Supply Shortages, and Rising Gas Prices… What’s Next?

- Podcast •

- 9/28/2021

Biden’s Inflation Problem

- Article •

- 10/11/2021

Stopping inflation is going to hurt

- Article •

- 5/15/2022

Why Printing Trillions of Dollars May Not Cause Inflation

- Video •

- 6/21/2020

Biden Advisors Say Pandemic, Not Policies, Fueling Inflation

- Video •

- 10/14/2021

Biden Finally Faces Inflation Fiasco — But Won’t Admit He Caused It

- Article •

- 10/11/2021

Joe Manchin: 'I cannot vote' for Build Back Better amid 'real' inflation

- Video •

- 11/19/2021

Biden Insists Infrastructure Spending Bill Will Help Ease Inflation Crisis

Democrat Lawmaker Slams Biden Inflation as Consumer Prices Hit 30-year High

- Video •

- 10/11/2021

Republican Senators Excoriate Biden For Inflation; Trash Build Back Better Plan

- Video •

- 10/16/2021

High Meat Prices Are Helping Fuel Inflation, And A Few Big Companies Are Being Blamed

- Article •

- 8/14/2021

WTH is going on with inflation? Are rising prices a temporary, post-COVID phenomenon or here to stay?

- Podcast •

- 6/7/2021

Senate sends massive $1.5 trillion spending package to President Biden even as Americans get hammered by soaring inflation

- Article •

- 2/10/2022